Use the interactive home loan EMI Calculator India to calculate your home loan EMI. Get all details on interest payable and tenure using the home loan calculator.

Friday 31 March 2017

Friday 24 March 2017

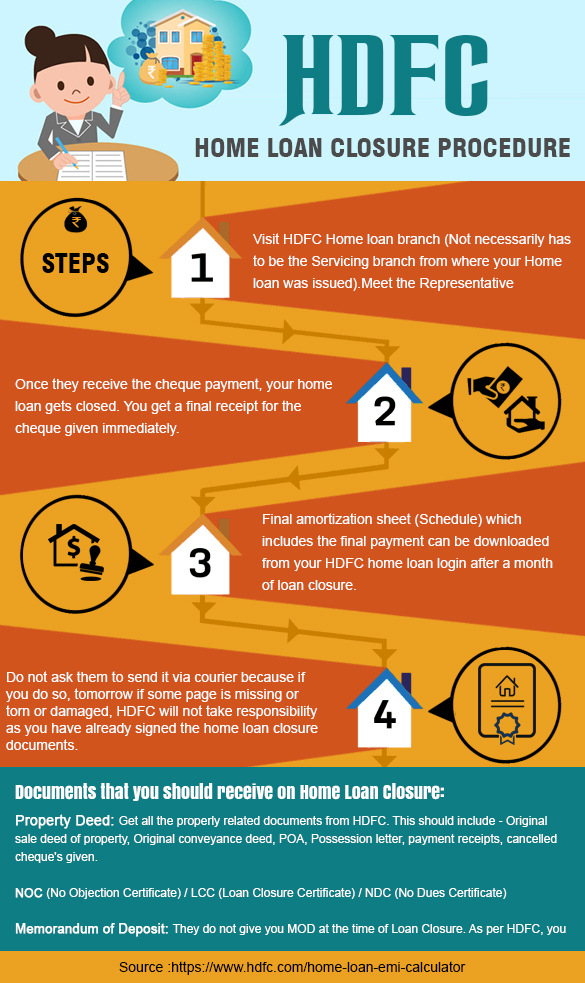

HDFC Home Loan Closure Procedure

Use the interactive home loan EMI calculator to calculate your home loan EMI. Get all details on interest payable and tenure using the home loan calculator.

Monday 20 March 2017

A Guide to Secured Loan For Home Owners

When you're looking for a loan, it can often be difficult to

decide what sort of loan you should get; after all, there are a number of

options available. Unfortunately, not all of the options that you might find

will be appropriate to your needs; if you own a house, then you might be best

served looking at some of the available secured loan for home owners.

By considering secured loan for home owners, you might open

yourself up to lower interest rates and better loan terms than you previously

thought possible. Best of all, you'll likely be able to find some secured loan

for home owners that will give you a good rate regardless of any credit

problems that you've had in the past. To assist you in your search, here are

some basic facts about secured loan for home owners that should help you to

better understand how these loans work and how to find your best deal.

Why Is Home Ownership

Important?

Obviously, when you're looking for secured loan for home

owners it's important that you actually own a house. The reason for this isn't

that lenders are trying to be elitist, but instead that they offer specialized

loans which are based upon the value of the equity you've built up in your

house. If you don't know what equity is, don't worry; it's simply a measure of

how much you've paid into your mortgage in relation to the total value of the

house. Because of the higher value of equity in comparison to many other forms

of collateral, lenders are generally able to offer loan rates and deals to

individuals who would otherwise not be able to get them.

Does the Mortgage have

to be paid in Full?

No, your current mortgage doesn't have to be paid in full

for you to qualify for secured loan for home owners. The loan is based only on

the equity, instead of the full value of the house... and your equity is only

representative of the amount of your mortgage that you've paid. When you take

out an equity loan, you likely won't be able to borrow more money than you have

equity built up for this reason. If you borrowed more, then you would be

borrowing against value that was already tied up in the mortgage.

Do Interest Rates

Vary Among Lenders?

Yes, interest rates can vary greatly among different lenders

who offer secured loan for home

owners. This is the reason that it's important to take your time and select a

lender that's truly right for you, meaning that they offer you a good interest

rate and flexible loan and repayment terms so as to keep your payments low and

manageable. When taking out larger loans or using high-value collateral such as

equity, it's important that you always take a little bit of extra time to

search for the best loan that you can get.

How Do You Find the

Best Loan?

In order to find your best loan, you'll have to shop around

at a variety of different lenders and request quotes for secured loan for home

owners. Visit several different banks, mortgage lenders, finance companies, and

even online lenders, and begin comparing the different quotes that you've

received based upon the interest rates and loan terms that each offers. This

will likely show you a range of loan offers, and you'll be able to easily pick

the offer that has the best rates for you and your new loan.

Wednesday 15 March 2017

How to Apply for Home Loans in India

Building their own home is a dream that most Indians share.

In fact, it is one of the most highly valued dreams too and rightly so. With

real estate prices rising and falling constantly, along with changing interest

rates and banking policies, home buyers need to be especially careful while

financing their homes.

Home Loan India is

pretty much a mandate today for engaging in a transaction that involves as much

money as building or buying your own home. Here’s how the process of applying

and disbursal of home loans work:

Home Loan Process:

·

Applying

for a home loan:

By providing a formal application for a home loan, along

with your personal details the bank will judge your eligibility for the loan

that has been applied for. Click here to Understand Home Loan Eligibility. The

bank will also require a whole set of documents including:

- ID Proof

- Address Proof

- Age proof

- Proof of educational/professional qualifications

- Employment details

- Bank statements

- Proof of income

- Pan Card

- Property details

·

Paying

the loan processing fee:

For commencing and maintaining your home loan, banks charge

a processing fee that usually amounts to somewhere between 0.25% to 0.50% of

the entire loan.

·

Applicant

scrutiny and verification:

This process involves the bank gauging the applicant’s

ability to repay the amount that is being borrowed. This is based on the amount

the applicant would like to borrow, as well as the value of assets that is in

possession with the applicant. His/her regularity in the payment of previous

loans that they were taken will also reflect on their eligibility.

After evaluation the bank will decide on the principle

amount that they can grant as loan.

·

Drafting

Home Loan offer letter:

If the bank is satisfied on all counts regarding who you are

and your ability to make payments, they will proceed to draft an offer letter.

It will contain details of the loan, such as:

- Sanctioned principle amount

- Interest rate charged

- Fixed or floating interest rate charged

- Loan tenure

- Method of repayment

- Terms and conditions

- Special schemes

A signed acceptance copy is then provided to the bank if the

applicant finds offers acceptable.

·

Property

verification:

Before disbursal of the loan, the bank will ask the legal

documents pertaining to the asset in consideration to be turned over for

inspection.

·

Disbursal:

If all of the above mentioned processes have been cleared,

then the Home Loan will finally be disbursed.

Every new business treats the customer as king. Hence,

despite the long Home Loan processes that are usually involved in getting your

own housing loans sanctioned, banks today go to great lengths to make sure that

there is as little hassle for the customer as possible.

With the dawn of the internet age, the home loan application

and disbursal processes are now being hosted online as well. This adds to the

convenience factor to this process, which is previously considered long and

harrowing, and plagued by constant red-tape.

Tuesday 14 March 2017

Calculate your monthly installment with online calculators.

Use the interactive EMI Calculator Housing Loan to calculate your home loan EMI. Get all details on interest payable and tenure using the home loan calculator.

Thursday 9 March 2017

7 Benefits of Loan for Home Owners

Most financial lending institutions offer loan for home owners.

These loans take the form of home equity loans, meaning that the owner of the

home willingly puts up his/her equity in their home against the amount of money

the lender is willing to lend them.

In other words with such loan for home owners, the home

becomes collateral for the finance company, credit union or bank. If the owner

defaults in their repayments of the loan then the lender can dispose of the

home on the open market to regain the amount of money lent.

But do not let this put you off looking into home equity

loans. They can offer significant benefits and advantages to the homeowner,

such as:

1. Money from loan for home owners can be used for any

worthwhile purpose. These include home renovation and maintenance, personal

uses like travel, buying a car etc, college education, other forms of

investment including real estate, investing in a business, consolidation of

debt, and cash for financial and medical emergencies and so on.

2. Rates of interest with loan for home owners are normally

fixed with a level repayment amount month after month for the term of the loan.

This means you know exactly what amount of money to budget for each and every

month.

3. Because the owner's home is security for the loan,

lenders will generally give a lower interest rate than the normal mortgage home

loan. This makes loan for home owner’s

cheaper forms of credit than other types of finance available.

4. If the homeowner has a bad credit rating but has equity

in their home they are still able to receive homeowner loans, even though

sometimes they can be charged with a higher rate of interest.

5. The amount of equity in a home is worked out by looking

at the variation between the value of the home at market prices and the amount

remaining on the initial home loan. Most lending institutions are looking for

at minimum of only 20% equity in the home.

6. Loan for home owners is easier and simpler to get than

normal mortgage loans. In fact, if a homeowner meets the criteria re: income,

credit rating, property values etc, they can even apply for and get a loan

approved online or over the phone.

7. Loans for homeowners can be applied for not just for

private homes, but if equity is held in different types of property such as

factories, apartments, commercial properties etc it can be security for similar

types of loans as well.

Wednesday 8 March 2017

Tax Benefits Associated With Housing Loans

Multiple benefits -

how?

EMIs (elementary monthly installments) consist of two parts

- the interest portion and principal amount. Interest paid is allowed as a tax

benefit under section 24(b) (subject to restrictions), while the principal

amount repaid is allowed as a deduction under section 80C.

Maximum ceiling on

tax benefit

Maximum tax deduction for repayment principal component of

home loan can't exceed Rs 1, 00,000 under section 80C. One should keep in mind

that other investments/contributions are also allowed as a deduction under

section 80C, and this limit of Rs. 1, 00,000 applies to all of them put

together.

Housing loan interest deduction, on the other hand, is

allowed up to a maximum amount of Rs 1, 50,000 under section 24(b). However,

the acquisition or construction of the house property should be completed

within 3 years from the end of financial year in which loan was taken;

otherwise, the amount of interest benefit allowed is only up to Rs 30,000.

Furthermore, the above tax deduction limit u/s 24(b) is

applicable only for self-occupied house property. In case of let-out or deemed

to be let out house property, interest is deductible without any limit.

Starting date for

claiming tax benefit

Some say that deduction on principal component of home loan

under section 80C is allowed as soon as one starts repaying the home loan. Some

say deduction is allowed only once the construction is completed. The law isn't

clear on the matter; hence the ambiguity remains.

Interest deduction on housing loan under section 24(b) is

allowed only on acquisition or completion of the house property. However,

interest deduction for pre-acquisition or pre-construction period is also

allowed but only after acquisition or construction is complete. It is allowed

in 5 equal annual installments. But even after including the above, the total

deduction should not exceed Rs. 1, 50,000 per annum.

Source of home loan

Unlike section 24(b), Section 80C doesn't allow tax

deduction for home loans taken from friends and relatives. For claiming tax

benefit on principal component of the home loan under section 80C, you need to

borrow only from the lenders specified in that section. There is no such

restriction under section 24(b) of the IT Act for claiming tax benefit on

interest component of the housing loan.

Purpose of housing

loan - Home purchase / construction vs.

Home improvement Deduction under section 80C for principal

portion of the housing loan EMI is not allowed if the home loan borrowing is

for the purpose of reconstruction, renewal or repair of house property. Put

simply, tax benefit under section 80C is only allowed for buying or

constructing a new home. In contrast, deduction for Interest is allowed under

section 24(b) even for the loan taken for the purpose of repair, renewal or

reconstruction of existing house property but subject to the limit of Rs 30,000

in case of self-occupied house property. In case of let out house property,

actual interest is allowed without any ceiling.

Payment Basis - Due

Basis vs. Cash Basis

Tax benefit u/s 80C can be claimed only when the actual

payment is made. Interest deduction u/s 24(b), on the other hand, is allowed on

accrual or due basis. Put simply, unlike principal portion, interest deduction

can be claimed even if not paid.

Restriction on sale

of house property

The tax benefit under section 80C is allowed subject to the

condition that the said house property should not be sold before a period of 5

years. If you violate this, the deduction will be discontinued and the entire tax

deduction claimed in earlier years under section 80C - for repayment of

principal component of the home loan - will be deemed to be your income in the

year in which you sell the property. However, the same doesn't apply on the

housing loan interest deduction claimed under section 24(b).

Home loan prepayment: Original loan vs. Subsequent loan

Tax benefit on interest component of the home loans u/s

24(b) is allowed not only for original home loan but also for subsequent

loan(s) taken to refinance the first loan. In other words, if the new housing

loan is taken to pay off an existing housing loan, tax benefit under section

24(b) is allowed. However, unlike section 24(b), there is no specific mention

under section 80C for prepayment of existing home loan by taking a fresh home

loan.

So what it means is that when you repay the balance

outstanding principal component of your existing home loan by taking a second

home loan, you'll be entitled for tax deduction under section 80C but within

the overall limit of Rs one lakh. Further, when you subsequently start repaying

your second housing loan, you'll be entitled for tax benefit only on the

interest portion u/s 24(b) and not on the repayment of principal component u/s

80C.

An online guide to simplify your home loan emi calculation

Use the interactive Home Loan EMI Calculator to calculate your home loan EMI. Get all details on interest payable and tenure using the home loan calculator.

Tuesday 7 March 2017

Getting a Home Loan

A 'home loan' or 'secured home loan' is one where the

borrower pledges an asset, in this case - your property (or in some cases a

car) as collateral for the loan. When getting a home loan remember that the

loan is secured against your property. If you cannot keep up repayments the

lender will, in some cases, take possession of the asset. A home loan will

usually offer a rate of interest and terms which is more favorable than an

unsecured loan, because the lender is relieved of most of the financial risks involved.

Getting a loan can be a somewhat tedious process at times.

Be aware that not every lender is the same, so ensure that when getting a home

loan to check the terms of each one before your make your choice. When making

your search remember to compare details such as loan repayment period and

interest rate before committing to any decisions.

One of the first things that you will probably be comparing

when getting a home loan is the interest rate of the loan. By no means is this

the only thing which you should consider, but it is a very important part of

choosing a loan. Over the period of the loan, even a small difference in

interest rates could mean hundreds or thousands of pounds. Compare the interest

rate of each lender along with other factors prior to getting a home loan.

Remember not to choose a company who charges an interest rate which is higher

than others.

The next thing you should look for is the repayment term;

some people consider the repayment term to be equally as important as the interest

rate. When getting a loan, lenders will vary on the length of time they will

allow you to repay the loan. For instance, say you wish to borrow £5,000 - the

first lender may have the lowest interest rate but will only allow you two

years in which to repay it. This may not be to your needs. Your best option

when getting a home loan is to

make use of the tools and sites online and go with a loan which you feel most

comfortable with.

Processing fees are charged by certain lenders. Be wary of

these, as sometimes lenders will use them to offset a lower interest rate. In

most cases, they will be tied to your credit worthiness. You need to be clear

about which fees you will be charged prior to getting a home loan.

The most common way for people who are getting a home loan

to pay is through having their bank accounts deducted on a monthly basis.

However, many online lenders will still offer a variety of payment methods.

Some people prefer to use credit or debit cards to complete the transaction.

There are also minorities who wish to use a personal cheque, and lenders will

still offer this - for now.

The bottom line is that when getting a home loan; select a

lender who will offer you your preferred method for making payments whether it is

cheque, direct debit or credit card.

Also, be aware that some companies may charge an early

repayment fee. This means that when you pay your loan back earlier you may be

hit with a charge. If you think that there's a chance you could repay your loan

earlier than expected, be sure to check the terms of the loan. Use a price

comparison site, or broker to ensure that you get the most competitive deal

when online.

Monday 6 March 2017

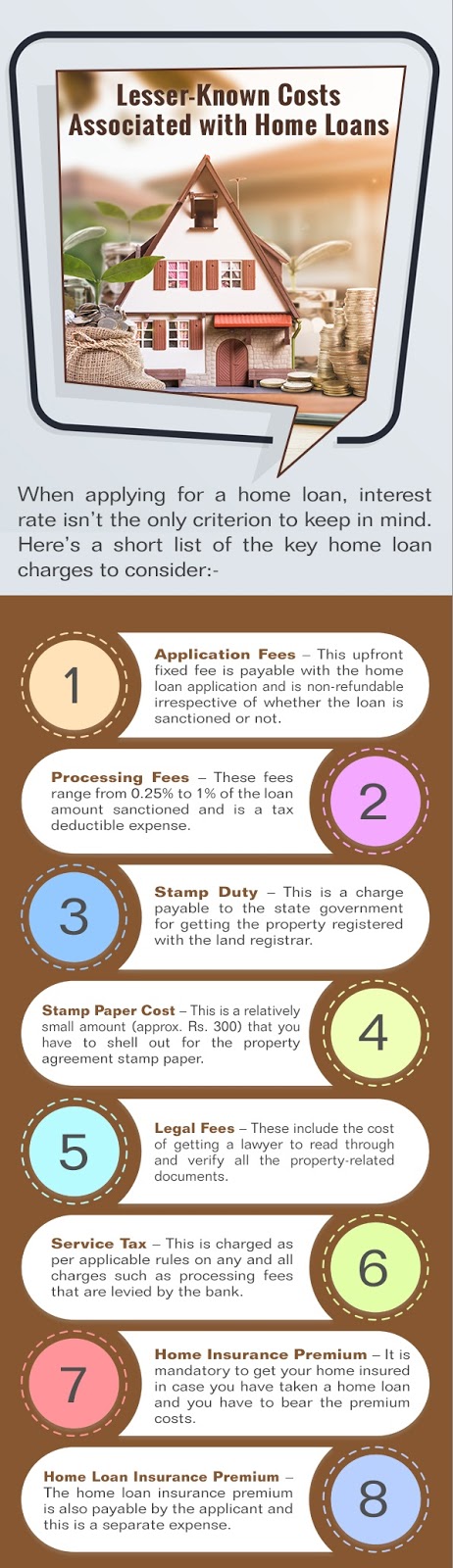

Lesser-Known Costs Associated with Home Loans

Loan For Home Construction - Go with HDFC home construction loan and you can build your home your ways. Visit us to know more about HDFC construction loan.

Saturday 4 March 2017

Obtain a Governmental House Loan

In today's market, purchasing a home can be an intimidating

process - especially for the first time buyer. Interest rates are at an all

time high and owning a home can often seem like a far-fetched fantasy for many

prospective home buyers. Fortunately, government house loan can make that dream

a reality and obtaining a loan is easier than ever. Government house loan are

available at the Federal and state levels.

Federal government house loan are administered primarily

through the US Department of Housing and Urban Development. The Federal Housing

Authority, an arm of HUD, has been around since 1934 and provides incentives

for private lenders to provide mortgages for people who otherwise wouldn't be

qualified. The FHA does this primarily by backing the loans with Federal money,

reducing the risk of loss to the private lender. The end result is that it

becomes easier for someone who has little or no credit history to receive a

loan to purchase their home because the FHA provides the mortgage insurance on

the home themselves.

A government house loan can be a great way to secure a

mortgage for your first home. There are also loans available to renovate your

home to make it more environmentally friendly or for assistance when purchasing

a "fixer-upper." When obtaining a loan for a fixer-upper, the

government will allow you to include the cost of renovations in your original

mortgage amount. An FHA loan also provides several benefits over a more

traditional loan, such as lower monthly payments, interest rates, closing costs

and reduced credit history requirements. In order to obtain an FHA backed

government house loan, one

must contact an FHA lender.

How to apply for a Home Loan

Use the interactive home loan EMI calculator to calculate your home loan EMI. Get all details on interest payable and tenure using the home loan calculator.

Friday 3 March 2017

9 Myths About Home Loans Exposed

Use the interactive house loan EMI calculator to calculate your house loan EMI. Get all details on interest payable and tenure using the home loan calculator.

Subscribe to:

Posts (Atom)