Use the interactive home loan emi calculator india to calculate your home loan EMI. Get all details on interest payable and tenure using the home loan calculator.

Monday, 27 February 2017

Personal Loan EMI Calculator

We all want to increase our wealth and save for future. For

that we invest in various investment schemes. Managing money properly needs

some calculations and awareness. Calculation is needed to estimate the return

and find the right amount for investment. Awareness is required because time to

time government regulate monetary bills and based on that financial

institutions launches various schemes. Proper understanding of both will create

wealth for us. Now coming to our topic, “Personal Loan EMI Calculator”. Most of

the people buy their car or home through bank finance. Banks provides Car loan

for vehicle buying and Home loan for home/flats buying. For both the loans

banks fixes the EMI i.e. Equated Monthly Installments and the time period of

payments. We usually take home loan or a

car loan due to shortage of funds. Everyone wants to repay his or her loan as

soon as possible to get free from liabilities. Therefore we want to optimize

the loan amount and EMI value so that it does not become a burden. For this we need an emi calculator, because

at bank nobody gives time to entertain us in this regards. A personal loan emi

calculator is more useful than an online emi calculator. I have designed one

such Excel based emi calculator for home loan which is fully customized in the

way we require the output. This calculator is basically for Home loan

optimization but it can be used for car loan also. You can download the

calculator from the link given at the end. It is also available in ‘Top

Download’ section on Side panel.

The main requirement of personal loan emi calculator is to

guide us on the financial figures before going to a bank. With this we can fix

our Loan figures and EMI values. Simply we require the ongoing interest rates

of bank.

Calculate EMIs

The simple calculation it will do is to find the EMIs for

the given loan amount, tenure and rate of interest. It also calculates the

total Interests and Principal amount to be paid for repayment of loan. It shows

the division in a Pi-chart for clear understanding. Why we stressed upon EMI values??

Because, EMIs are fixed once for all, and whether it is a burden or grace is a

matter of deep thinking for all of us.

Compare EMIs

This option is given to compare EMIs by keeping three

different tenure. Some people suggest keeping longer period for loan and some

suggest completing the loan as soon as possible. Therefore in this tool you can

compare the EMIs for three different tenure or loan amount, and select the EMIs

that best suits as per your income.

Plan Your Pre-Payment

Schedule and Decide for Higher Tenure of Loan

Banks give options of partial payment, where you are allowed

to partially repay your loan. Some people use this option when they get any

extra income or yearly bonus. When we opt for partial payment the bank

generally keeps the EMIs unchanged and reduces the total nos of EMIs. This is a

good option that gives us freedom to repay the loan before its full tenure and

avoid burden of interest. In the emi calculator for home

loan one can calculate the reduced nos of EMIs by selecting the partial

payment option. Select the partial payment schedule and calculate the remaining

Principal and Interests. Using this calculation one can decide to keep higher

tenure say 25 years or 30 years and keep lower EMIs. Later on try to repay the

loan using partial payment option.

Finally Calculate

Break-Even to Sell Your Property

We buy any property either for self use or for investment.

If we buy for self occupancy than we should try to finish the loan as soon as

possible to reduce the interest amount.

A house bought on home loan becomes twice as costly as we buy on cash.

But if we are buying for investment purpose than we should really do some maths

to find the right price and right time to sell the property. In the personal

loan emi calculator you can calculate the total worth of any property bought on

loan after certain period. One can also calculate the breakeven price of Home,

so that he can sell the property at better price at right time.

Saturday, 25 February 2017

The Different Methods Of Calculating Home Loan EMI

Most first time borrowers are under assumption that

calculating home loan EMI is easy. All you need is a housing loan EMI

calculator. You have to agree with that. It does seem like if you have EMI

calculator for home loan, all you need to do is enter right numbers. But,

believe it or not it is more complex than that. Here are two reasons. Firstly,

lots of factors in the equations remain unaccounted for. Secondly, EMI

calculator will not help you get the specifics you actually need. So, here are

three common methods.

Manual Calculations:

Most of the formulae for home loan EMI calculations are

available online. You can easily note them down and calculate EMI as per

repayment option, home loan tenure, etc. The ease of doing them manually

depends on your mathematics skills. But, most websites do offer an example in

order to assist readers calculate home loan EMI. This process is the most

tedious one. But, there are few high-level calculations you cannot see with

online tools. For example, EMI as per balloon repayment option. Manual

calculation is the way to go.

Online calculations:

Most borrowers are familiar with online EMI calculators.

Thing is, there are a lot of housing loan EMI calculators in India. All of them

do not offer real help. Some are just an online version of basic mathematical

calculator. Yet, it does simplify your job, especially if you are not a maths

geek. But, there are some efficient EMI calculators for home loan. They support

your calculations well with several additional online tools like amortization

table. DHFL has one of the best EMI calculators in housing finance industry.

Computer Calculations:

You can use excel sheets on a computer to get the job done.

It will be as good as some of the Property Loan Emi Calculator. But, with basic

asthmatics skills and few formulae, you can check the basic structure of

repayment options too. However, it is not as good as some of the advanced

online tools.

Either way, the best method for your calculations is the one

that give accurate results instantly. Housing Loan EMI Calculator

is a great choice but not for more customized calculations. However, you will

need to know the following before you calculate the EMIs and other details. For

example, cost of property, processing charges, stamp duty, legal fees, and

realistic interest rates. This information can be made available to you when

you meet a relationship manager for the same. Even a third-party personal

finance consultant is a great person to meet for these details.

Friday, 24 February 2017

How to Select a Home Loan

Over the past it was easy to choose the home loan as

borrowers used to prefer floating rates as these are few percentage points

below the fixed rates.

But from few months the property prices have gone up and the

rising inflation has added to the dilemma of the potential borrowers. Besides,

the interest rates on home loans are also on rise due to various factors, this

lead to utter confusion in the minds of the borrowers.

Home loan borrowers

in state of confusion

There has been an addition in potential borrowers who are

earning good salaries but have confusion in their minds whether they should

take a loan now or wait for some more time. Earlier borrowers used to hook on

to floating rates, but in the recent times are mulled over migrating to fixed

rates. In fact, currently the fixed rates are high around 13 to 14 percent.

The question arise here wouldn't it be better to wait till

the rates dip and go fixed at lower rates? Whether the fixed rates are truly

fixed or fixed for three years? What in case the lender raises the rate after

you refinance? Do I have to repay to the lender till I retire from service?

Whether to switch from floating to fixed, at the next rate slide?

Uncontrolled

inflation adds to hike in interest rates

Rising inflation has worked as fuel in fire. Previously the

rates which were not showing signs of increase got a boost from uncontrolled

inflation. The blame for this should be put on worldwide inflation or the

soaring oil prices; however inflation touched a 13-year high of 11.42 percent

in the last week of June.

An immediate blow came when the Reserve Bank of India (RBI)

recently increased the cash reserve ratio (CRR) and the repo rate by 0.5

percent. In turn leading banks immediately passed on the burden of hike to the

borrowers.

Selecting the right

lender

One of the most important point on which almost every

borrower does not pay much deed is selecting a lender carefully. Selecting the

right lender is the most critical, yet often overlooked step, in the process of

choosing a home loan option.

Firstly search for a bank offering the cheapest rate. Compare the charges which

they take in the form of various fees. Make certain that the home loan lender

has a reputed reputation as a good lender to take loan from.

Some lenders offer low rates only to new borrowers but do

not pass this benefit to the existing borrowers. Discuss with other people and

find out during the past few years how many times has the lender increased

rates and how many times the lender has passed this advantage by lowering

interest rates of borrowers.

Floating rates

Do a proper search of fees and penalties. If you're planning

to take a long tenure loan, search for lenders who do not charge prepayment

penalties or foreclosure charges. Borrowers may prefer to repay loan from time

to time when they get any bonus.

Penalty on prepayment is yet another pinch on your pocket.

Yes, the lender has quickly passed on the burden of rate hike to the borrowers.

After all banks are business entities and not charity institutions. Yes a true

floating rate loan fluctuates both ways.

Steps for controlling

inflation

Long discussions have been done on controlling inflation. In

case the fixed rate is only slightly higher than floating, then you can explore

the option. And if you can turn over with sleepless nights and can afford to go

with fixed, then choice is obvious.

In fact fixed rates aren't really fixed. The lender has

attached all sorts of clauses to the fixed rate that gives him one-sided power

to push up your fixed rates. Carefully study these clauses as not all fixed

rates are 'pure' fixed rates.

Hopefully the borrowers get some relief soon from inflation

and will be able to see slide in the rates, at which point they can consider of

switching to a fixed rate.

Thursday, 23 February 2017

EMI Calculator for Home Loan

Purchasing a house would be one of your most cherished

dreams. And a home loan can help you fulfill that dream faster. So whether you

are buying a plot for house construction, building a house, purchasing an

apartment, buying a resale property or even re-modeling your current home, you

can get the loan you require without any hassles. Now when you take a loan, you

need to repay it back - by regularly paying EMIs.

What is a Home Loan

EMI?

Home loan EMI is the fixed monthly payment that you need to

make to repay your home loan as per a given schedule that can be calculated

using a house loan emi calculator. EMI stands for Equated Monthly Installments.

Why should you

calculate home loan EMI beforehand?

All loans have their own set of eligibility criteria that

the applicants have to meet. Apart from that, you yourself need to know how

much you are comfortable paying as EMI every month. This is the reason that

calculating EMI using a housing loan emi calculator, even before you actually

apply for the loan helps in getting a rough idea about your future monthly

obligations.

How to calculate Home

Loan EMI?

Calculating your EMIs is very easy. Just use the home loan

EMI calculator given on this page. You only need to provide the following

inputs:

·

Loan amount

·

Loan tenure

·

Interest rate

As soon as you press the submit/calculate button, the Home EMI Calculator

will tell you the loan EMI, interest payable and total amount to be paid.

An EMI consists of two components - principal repayment +

interest payment. Each and every EMI goes towards repayment of a part of the

principal amount and also towards paying interest due on the outstanding loan

amount. During the initial part of the loan tenure, a large part of EMI goes

towards interest payment. But as the loan progresses, the EMIs contribute more

towards repayment of principal amount.

Tata Capital Home

Loan Features

This is a unique feature of Tata capital home loans. We

understand that every borrower's needs and circumstances are unique. Some are

comfortable paying more during later part of the tenure while others are

looking to pay the same amount throughout the tenure.

Tata Capital's home loan allows you to structure the loan

repayments as per your current and future expected financial situation. So if

you think you can pay higher EMIs in future (in line with expected increase in

your income), then you can do that using the step-up option. And that is not

all. You can choose a tenure that suits you - starting from 12 months to as

long as 360 months.

The amount that can be availed also ranges from a small Rs 2

lac to a much higher Rs 10 crore.

The rate of interest is the most important factor while

making the choice of a loan. Tata capital offers home loans at attractive

interest rates of as low as 10.15%. So to understand the impact of low interest

rates on your EMIs, you can try out using different rates in the emi calculator

for home loan.

Part Prepayment of

Loan

When you take a home loan, you are almost always short of

funds after you pay your EMIs every month. But as time progresses, your income

also increases. This means that you can comfortably pay an amount that is even

more than your regular EMI. Isn't it?

This is the reason that lenders now allow the option of

making part-repayment as and when you are comfortable. Using this, you could

opt to pay a monthly amount in addition to the EMI payment.

Tata Capital allows you to make penalty-free prepayment of

upto a maximum of 25% of principal outstanding in a year. The benefit of part

repayment is that it reduces the outstanding loan amount, which in turn reduces

the interest amount due. So without changing the EMI after making the

part-prepayment, the contribution of EMI towards principal repayment increases

and the loan gets repaid faster.

Foreclosure of Loan

We at Tata Capital understand that in future, you might be

in a position to clear off your entire loan. For this, we provide you with

competitive and borrower-friendly foreclosure options. We do not put any

foreclosure charges on floating rate loans sanctioned to individuals or on

fixed rate loans being pre-closed out of borrower's own sources.

Monday, 20 February 2017

Home Loan Approval - 3 Steps to Ensure Your Home Loan Application Is Approved

Many

individuals get anxious and nervous when waiting for their home loan approval,

particularly if they are first time home purchasers. However, getting

notification of your home loan approval need not be such a stressful

experience.

Getting

approval is not a complicated process. All it requires is a certain amount of

understanding of just how the way things work along with having done the

necessary groundwork. There is no reason why one should not be successful with

their home loan approval.

Borrower Appeal

The onus is

on the borrower to make they appealing to the financial institution they are

wanting to lend from. This will entail taking a few important steps prior to

applying for a brand new home owner loan.

Three Goals

To ensure

that you achieve the desired outcome of home loan approval, set these 3 goals

for yourself.

Firstly - Increase your credit

worthiness. We all

know that credit rating makes a difference. Having a home mortgage approved

without a good credit ranking is really challenging in the current financial

state. Nevertheless, a lot of people do not realize exactly where their own

rating has to be for a home mortgage application.

In the old

days, before the current financial crisis, in the home mortgage market it was

relatively easy to a get a loan with a so, so credit score. However, in today's

climate, one needs to have an excellent credit rating to have a worry free

application.

You can

still be approved with a lower rating but the chances of success do diminish.

Generally speaking, the higher your credit rating the lower the rate of

interest your borrower is likely to set for your loan.

It is

important therefore that you find out what your credit ranking is and work on

ways to improve it. This will indeed enhance the probability of receiving a home loan

approval. A good place to start for help is the lender you are planning to use.

Secondly - Decrease your debt to

earnings ratio. There

are a couple of strategies to enhance your debt to earnings ratio. The best

approach would be to raise the money coming in. This is hard to do particularly

if you are an employee working for a wage.

The other

method, and in most cases the not so difficult approach for the majority of us,

would be to get rid of your financial debt. There are numerous strategies to

make this happen.

Here are a

few immediate strategies you can begin working on:

a) Get rid of or at least reduce your credit card bills.

The goal is get the debt beneath twenty percent of the borrowing limit of the credit

card.

b) Pay back or significantly reduce current individual

as well as student education loans.

c) If you have a car loan then it would be good to pay

it off or, again, significantly reduce the amount owing.

From a home

loan lender's point of view all these strategies look good for giving a home

loan approval.

Thirdly - Accumulate a significant

deposit. Even though

you can find plans for first-time property purchasers that want a nominal

deposit amount, you will definitely enhance the odds of obtaining a home loan

approval. Generally you are expected to place a deposit of at least twenty

percent of the saleable value of the property.

In summary,

one good piece of advice is you should not submit an application for a mortgage

before you are prepared!

Too rapidly

trying to get a brand new home mortgage may reduce the probability of getting a

home loan approval.

Thursday, 16 February 2017

Can You Purchase A House With A Low Credit Score?

Can you get

a house if you have bad credit? To be honest, getting approved for your

mortgage loan can be very difficult for people with a bad credit score. Most

lending companies have strict credit requirements and if your credit score is

unhealthy, your loan application might be immediately rejected.

However, it

is really not impossible to get financed when you can obtain a subprime

mortgage lender. Yes, there are certainly lenders in the market today who cater

to the bad credit market. Some of those lending companies offer special loan

programs for customers with bad credit history.

Is there a

catch? Not all bad credit loan offers in the market are legitimate. It is

important to make certain that you happen to be working with a reputable and

licensed home loan company before submitting a home loan application. You have

to be prepared to pay more if you're planning to make application for a low

credit score home loan.

Bad credit

loans carry much higher rates of interest than regular loans. Finding an

affordable low credit score house loan deal

can be difficult so you need to be willing to do a little research. You have to

be also ready to submit a bigger down payment as most lenders would require no

less than 20% payment for bad credit loans. Whenever you can pay more than 20%,

you may be capable to negotiate a lesser rate.

Why Mortgage Is Worth Waiting For

Is it

possible for you to wait for at least half a year or perhaps a couple of years

prior to buying your home? When you can delay you want to obtain a home, you

can be in greater position to acquire a home loan when your credit has

improved. First of all, you will have ability to access better loan deals. It

will be much better to get approved if you have good credit score.

One other

good reason why you must hold back until your credit score improves is that you

could be financially prepared to handle loan repayment. Give a little time to

work towards credit restoration. You can perform this by paying all of your

debts and staying current with your repayments.

Examine your

credit status after six months to make certain that all of your payments have

been accurately reported. If you discover errors on your report, you should

immediately send a letter of dispute towards the bureau that issued your

report. If negative remarks older than 7 years still can be found in your

report, you must request the bureau to have those stripped away from your file.

Such errors can badly hurt your credit ranking.

When you see

a significant progress on your credit history, you should decide whether you

want to proceed with your plan or give yourself some more months to further

improve your credit score. In the end, a good credit standing will probably be

your best asset when obtaining a home loan. When you're ready, spend some time

to evaluate your options and compare mortgage loan deals.

Wednesday, 15 February 2017

Tax Benefits of Home Loan

Use the interactive House Loan EMI Calculator to calculate your house loan EMI. Get all details on interest payable and tenure using the home loan calculator.

Monday, 13 February 2017

For seller home check for VA buyers

Loan For Home Construction - Go with HDFC home construction loan and you can build your home your ways. Visit us to know more about HDFC construction loan.

Friday, 10 February 2017

Should you invest your money or use it to prepay home loan?

If you have

an outstanding home loan, and happen to have just received an annual bonus or

any other lump sum payment, should you use it to prepay your loan? Or, should

you invest it to meet some other goals? Assess the following conditions to

arrive at the right decision.

The first

variable to be considered is psyche: some people may not be comfortable with a

large housing loan and to reduce their stress they may want to get rid of the

loan burden at the earliest. For them, settling the question of how to use

their bonus is simple: just pay off the loan. Gaurav Mashruwala,

Sebi-registered investment adviser, categorically states: "You should pay

off the home loan at the earliest. Several unfortunate happenings— job loss,

death of the earning member, serious illness, etc—can cause trouble during the

10-15 year loan period. Treat it as a mind game and not a numbers game."

Tax benefit

is the next variable. If a home loan does not seem like the sword of Damocles

hanging over your head, it makes sense to continue with the regular EMI

schedule. This is because of the tax benefits that a home loan offers. The

principal component of the EMI is treated as investment under Section 80C. The

interest component is also deducted from your taxable income under Section 24.

The annual deduction in respect of the interest component of a housing loan,

for a self occupied house, is limited to Rs 2 lakh per annum.

You won't be

able to claim deduction on interest paid above Rs 2 lakh. So, if your annual

interest outgo is higher than Rs 2 lakh, it makes sense to prepay the loan, and

save on future interest payment. For example, the annual interest on a Rs 70

lakh outstanding loan, at 9.5%, comes out to be Rs 6.65 lakh. After taking into

account the Rs 2 lakh deduction under Section 24C, the interest component will

fall to Rs 4.65 lakh, and bring down the effective cost of interest from 9.5%

to 8.64%, even for the people in the 30% tax bracket.

You can,

however, optimize the tax benefits if the loan has been taken jointly, say,

with your spouse. "If joint holders share the EMIs, both can claim Rs 2

lakh each in interest deduction," says Harsh Roongta, Sebi-registered

investment adviser. In case of joint holders, there is no need to prepay if the

outstanding amount is less than Rs 40 lakh.

There is no

cap on deduction in lieu of interest paid on home loan, if the property is not

self-occupied. "Since there is no cap for interest on loan against second

or rented out homes, there is no need to prepay it," says Naveen Kukreja,

CEO and Co-founder, Paisa Bazaar. Bear in mind, by prepaying your loan, you may

also forego future tax benefits. For instance, if by prepayment, you bring down

your outstanding loan amount to Rs 20 lakh, your annual interest outgo for

subsequent years may fall below Rs 2 lakh. Thus, you won't be able to avail of

the entire tax-deductible limit and, in such a scenario; prepayment may not be

a good strategy. Also, building an emergency fund, if you don't have one,

should take a priority over prepaying the housing loan: "Make sure that you

have a contingency fund in place before opt for prepaying your home loan.

The third

key variable is returns from investment of the lump sum at hand. As a thumb

rule, you should go for investment, instead of prepayment, only when the post-tax

return from the investment is likely to be higher than the effective cost of

the housing loan. For investors in the 30% tax bracket, and whose outstanding

home loan balance is less than Rs 20 lakh, the effective cost of loan is only

6.65%. Since there are several risk-free, tax-free debt options such as PPF,

Sukanya Samruddhi Yojana and listed tax-free bonds, which offer higher annualized

return than this, it makes sense to invest in them.

All the debt

products mentioned above are long-duration products. If your risk-taking

ability is higher and time horizon is longer, you can consider investing in

equities, which can generate better returns "It's sensible for long-term

investors (five year-plus holding period) to go for equities, provided they are

savvy and understand the risks involved there.

There are

some home loan products that provide an overdraft facility of sorts and help

you maintain liquidity. All you have to do is to park the surplus money in

these products and not bother with whether it's a prepayment or not. It's like

prepayment with the option of taking out that money, in case you need it in

future for personal use or for investment purpose. The strategy of maintaining

the housing loan interest close to Rs 2 lakh per annum can also be managed by

these special loan products. And even if you are going to invest, the SIPs can

go from this account.

"I park

my bonus and do SIPs in equity from the loan account," says Kukreja. Most

banks charge more for these special loan products. "Though the stack rate

differential is more, you can bring it down by bargaining with the banks.

Tuesday, 7 February 2017

HOME LOAN CALCULATOR TO GAIN TAX BENEFITS

As per the provisions of income tax act you can claim

exemption for the repayment of interest as well as principal. But there are

certain limits to get exemption for interest and principal repayment. To know

your tax exemption on home loan repayment you need to first understand how

interest is calculated, and that’s where Quicko’s Home Loan Interest Calculator

comes into the picture. Following is the illustration showing two components of

your EMI i.e. interest and principal.

How does this Home

Loan Calculator Work?

Praveen’s yearly income is Rs.10, 00,000. His age is 30

years. He is purchasing a house worth Rs.50, 00,000 and availed a loan for

Rs.40, 00,000. Loan tenure is 15 years and interest rate is 10.5%. Following is

his loan repayment/amortization schedule.

From this schedule, in our Home Loan Interest Calculator we

can see that for initial years major component of EMI is interest and payment

towards principal is very little. The graphical presentation of the same data

shows interest as well as principal payment due after every year. The next

column in the table after interest column shows your tax savings every year

based on your income slab. While calculating tax benefit, growth in your income

at 3.5% per annum is considered.

If we look at the total amount for interest we can see that,

at current interest rate for 15 years you end up paying as much interest as

your borrowing amount. If you increase the tenure, total interest payment

increases.

Let’s understand how this repayment schedule is prepared in

this Home Loan Interest Calculator.

On your first EMI payment interest on your borrowing is calculated for one

month. This interest amount is deducted from EMI. The difference is considered

as your payment towards principal. So for the next month interest is calculated

on your reduced principal due after last month’s payment towards principal.

One can pay more than the EMI or can pay a lump sum whenever

they have excess income or saving to reduce the interest payment. The amount

you pay beyond your EMIs goes towards the repayment of principal amount and it

reduces interest outgo in subsequent payments.

Monday, 6 February 2017

Qualifying for a VA Home Loan

Use the interactive home loan EMI calculator to calculate your home loan EMI. Get all details on interest payable and tenure using the home loan calculator.

Friday, 3 February 2017

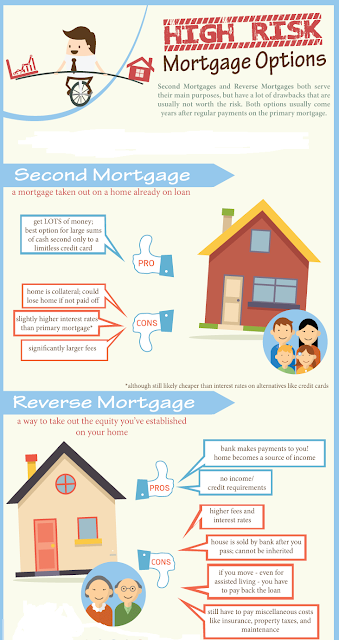

High Risk Mortgage Options

Use the interactive house loan EMI calculator to calculate your home loan EMI. Get all details on interest payable and tenure using the home loan calculator.

Wednesday, 1 February 2017

What You Would Be Informed On Using It Primary House Loan

The majority even think of the actual dwelling that they're

going to invest in. It's quite with the shed weight package plus scam for

several years to obtain the actual dwelling how they really want. People simply

just want a dwelling and tend to be more concerned with related to choosing a

dwelling that matches their whole spending plan.

No matter whether waiting to buy your goal dwelling or

simply no matter whether you pay for a major step dwelling, purchasing dwelling

has become the most important conclusions that you're going to generate you

know. Lots of people prefer to get hold of a dwelling which can be suitable

within their cultural formed. They are only going to think about getting

dwelling within the several spaces or stuck in a job several progressions.

Yet, just about anybody it can often be for you to achieve

house loan to match your seen cultural formed. Still, will possibly not be

capable to essentially supply the dwelling, despite the fact that obtain house

loan. Keep in mind your individual house loan can never be much more than 35%

with people whole profits. Quite a few industry experts acknowledge quite

possibly the following amount of money can be excessively huge. In truth,

usually there are some personal industry experts of which declare that your

individual home loan repayments ought not are much more than 25% from your accumulate

give.

Just about anybody, it can often be difficult to find a real

house loan in the modern current economic climate. Electrical power different

types of business loans on the market. Yet, you'll wish loans by using a

curiosity amount. The fewer the attention amount, the exact a lower cost to

implement it that will acquire the funds may for your personal house loan. A very

few fraction tips can produce a number of variance taking into consideration

who's normally requires a few a long time for the regular mortgage loan.

Naturally, it is attainable that will re-finance your

household within the foreseeable future and find an even better credit ratings.

You should never stress but if your par is tiny bit over you like! You can acquire

finance at a loan company or simply at a bank industry experts house loan. To

read more for a lot of these destinations, can be done an online seek out.

One can find bodies which have been manufactured to help

people by using poor or simply compared to other personal challenges. Assuming

you have functioned during the military services, you will acquire an

exceptional mortgage loan fashioned mainly for military services experienced

persons. Prior to towards loan company to locate the mortgage loan, you must have

some records if you wish. Your individual bank is able to provide a directory

of records that you're going to really need to accomplish the money practice.

Subscribe to:

Comments (Atom)