Use the interactive house loan EMI calculator to calculate your home loan EMI. Get all details on interest payable and tenure using the home loan calculator.

Tuesday, 31 January 2017

Wednesday, 25 January 2017

Home Loans Offer 5 New Ways to Get Your Dream Home

Use the interactive home loan EMI calculator to calculate your home loan EMI. Get all details on interest payable and tenure using the home loan calculator.

Tuesday, 24 January 2017

5 STEPS TO A SUCCESSFUL OPEN HOUSE

Use the interactive house loan EMI calculator to calculate your home loan EMI. Get all details on interest payable and tenure using the house loan calculator.

Friday, 20 January 2017

6 uncommon reasons for home loan rejection

After years

of search and brainstorming, Delhi-based Amit Khanna finally zeroed in on his

dream home in Gurgaon and subsequently applied for a home loan. However, as

Khanna waited for the approval came the bad news that his application had been

rejected. Khanna couldn't believe it because apart from having a high-paying

job, he had never defaulted on any loan and even the housing project was being

developed by a reputed builder. So why was his home loan application rejected?

Well, there

may be many reasons for a home loan rejection - some common and some not so

common or lesser known. Let's take a look at six uncommon reasons:

1. Builder not approved

This is one

of the most common but unexpected reasons for the rejection of a home loan

application. Not all banks give loans against the property of builders. It is,

therefore, critical to understand from the builders themselves which banks have

approved them and which have not.

"It's

possible that when you approach a bank or a housing finance company for getting

a home loan, you might come to know that the very builder is not approved by

it. If that is the case, then you might not only get the shock of your life,

but it will also make it impossible for you to get a home loan from the

concerned bank and you may have to go to a different bank for the same,"

says Parth Pande, co-founder of Finance Buddha, a marketplace for retail

lending products.

2. Builder approved but property not

approved

This is

another unexpected reason for a home loan rejection. A builder, for instance,

may figure in a bank's list of approved builders, but a specific project

launched by him may not have been approved by the concerned bank. In addition,

there are likely to be cases where particular phases of a project (if it's a

large one) may not have bank approval. Thus, to avoid unexpected home loan

rejections, it's important to check that apart from the builder, the entire

project - including its different phases - has got the necessary bank approval.

3. Valuation-related rejections

Imagine a

scenario where one is buying a house in the resale market. Both the buyer and

the seller mutually decide the price of the property and the buyer decides to

go for a home loan to fund

the purchase.

"The

bank or the housing finance company, however, would sanction the home loan on

the basis of the valuation of the property as ascertained by it rather than the

price decided by the buyer and the seller. If the valuation amount is higher

than the mutually-decided price of the property, then there is no issue.

However, if the value of the property is lower, then the bank may choose to

give a lower loan amount than required, or may even reject the home loan

application altogether," informs Pande.

4. If previous tenant was a defaulter

Many housing

finance companies (HFCs) these days blacklist both the defaulter and his

residential address. Therefore, if you are staying in a house which is in a

bank's defaulters' list because of the previous tenant who defaulted on a loan

or credit card payment, there are high chances of your home loan application

getting rejected. However, even if a particular address is not in the

defaulters' list, then there is a possibility that the very locality is not in

the good books of the banks/HFCs because of some other reasons. Your loan

application may get rejected in such a case.

5. Credit history issues

Many people

do not check their credit scores and are mostly oblivious to the same. For

instance, a survey conducted by credit health improvement company Credit

Sudhaar sometime back had revealed that more than 85% of the respondents were

unaware of credit bureaus, while a whopping 92% didn't know their credit

scores. No wonder loan rejection because of credit score issues comes as a

surprise to many loan takers.

Surprisingly,

even people with a credit score of 700 and above (out of 900) are sometimes

denied credit because of past mistakes. For example, there may be some old

payments or charges missed by them which they have forgotten about, or they

might have settled a loan long back. But the same can have a negative impact on

one's credit history and this alone can lead to the rejection of a home loan.

It's very important, therefore, that customers regularly check their credit

scores and fix issues, if any, around their poor credit history immediately.

6. Unstable employment

Lenders

place a lot of importance on job stability and certain banks even insist that

an applicant needs to be employed with a concern for three years or more to be

eligible for a home loan.

"Lenders

are very meticulous about the stability of an applicant's job. Before

sanctioning a loan, a number of lenders insist that one should have a stable

job and also be a permanent employee in a company. If these conditions are not

met, then one's application for a home loan will get rejected," says

Manish Shah, co-founder & CEO of financial services advisory platform

BigDecisions.com.

Conclusion

It is clear

that there are many uncommon/unexpected reasons for the rejection of a home

loan application, and one can't be 100% sure of getting a loan even if one is

earning a handsome salary or maintains a good credit score.

Wednesday, 18 January 2017

HDFC Personal Loan EMI Calculator

Getting a HDFC Bank personal loan is

easy for good credit record holders

A personal

loan (PL) is an unsecured, guarantor-less borrowing that helps an individual

finance a sudden and urgent need for money. An individual may require money for

a marriage in the family, sickness of a dear one or to pay admission fees for

their kids.

An Online

EMI Calculator is a handy tool available online so that borrowers of HDFC Bank

personal loan can find out their exact EMI well in advance.

Advantages of HDFC Bank personal loan

HDFC Bank

personal loans offer several benefits such as simplified documentation, quick

loan disbursal in 2 days, competitive pricing and transparency of its

paperwork.

HDFC Bank

provides easy personal loans to its customers. These loans are available at

highly competitive interest rates. You can find out your personal loan eligibility

in 1 minute online and across all HDFC Bank branches. The bank also has special

offers, interest rates and charges for HDFC Bank account holders.

Women

employees have exciting loan offers from the bank. The bank also allows you to

walk into few select branches with your documents and get personal loan in a

day. You can also track your loan application online. Customers have the

convenience of contacting the bank through web chat, SMS, Click2Talk, phone

banking and across all branches.

HDFC

personal loan has an Online EMI Calculator is an online tool that can let you

know how much EMI you would pay for a particular amount borrowed for a certain

term.

How does HDFC Bank personal loan EMI

Calculator work?

HDFC

Personal Loan EMI Calculator

Parameters

required for using the HDFC Bank personal loan EMI calculator:

• By filling

in the amount as you seek as loan, prevailing rate of interest and number of

installments you plan to make the repayment, HDFC personal loan Online EMI Calculator

tells you exactly what your Equal Monthly Installments will be like. Suppose

you choose to apply for a personal loan for Rs.5 lakh and at interest rate of

15 percent and repayment period of 60 months, your EMI will stand at Rs.

11,895.

• Sliders

and input boxes provided in the calculator are helpful to provide various

parameters of lending.

• After you

fill in the details, let the calculator display the total interest you pay EMI,

amortization table and the timelines of your loan repayment etc. and help you

decide.

The

functionality of the different loan parameters are helpful to know the total

cost of loan and in case the applicant chooses to prepay the personal loan as

they display the outstanding interest and principal at any point during the

loan term. HDFC bank’s personal loan EMI calculator thus is a very practical

tool for personal loan aspirants.

How a better credit track record

makes personal loan application easy?

The Credit

Information Bureau of India Limited (CIBIL) maintains a database of people

accessing credit in India. This database is shared across subscribing banks and

financial lending institutions so it is very difficult for an individual to

default on loan and get credit from another source. Since your CIBIL score is

linked to your PAN card, banks can immediately see what your other financial

commitments are and refuse or grant credit to you.

While the

HDFC bank personal loan Online EMI calculator will tell you in advance exactly

how much EMI you are going to pay and whether you can afford it, it is also

important to maintain a good credit history and keep paying your other loan

installments in time so that you maintain a good CIBIL score. Your personal

loan from HDFC Bank has a higher chance of being processed if your CIBIL score

is consistent and in good standing.

Friday, 13 January 2017

7 Tips to Help Save Interest on Your Home Loan

Here are 7

tips on to save on interest by paying your home loan faster.

Owning a

home is one of the most common aspirations among people from all walks of life.

No matter what his status in life is, every person will give anything just to

be able to build a home for his family.

There are

people who have been blessed with a fortune so they can easily build not one

but even two or more homes for their families. Some people who have made it

their life aspiration to own their own homes manage to fulfill their dreams by

availing of a home loan.

Owning a

home through a loan is not an easy task because first of all, the person has to

have a good credit history. He has to find a suitable mortgage provider that

can give him the amount he needs to buy or build his home. Not only that; he also

has to choose the best home mortgage he can get to maximize his financial

resources.

Before

finalizing his application for a home loan, any borrower should evaluate his

capacity to pay off his loan for a specific period. Loan providers prefer to

give long term loans because this is how they make money. Every borrower should

choose a pay-off period that is advantageous to him.

There are

advantages and disadvantages to getting a long term home loan. A long term long

can be beneficial to the borrower because he can negotiate minimal monthly

payments for his home loan. This would be advantageous for him especially if he

can negotiate a home loan with a fixed or locked interest. However, this can

also be disadvantageous for him if the interest rates go down.

On the other

hand, a long term loan can be disadvantageous for the borrower if the interest

rate is not fixed and sudden economic factors cause a notable increase in

interest rates. Getting a long term home loan can also

be more expensive because while the repayment term is long, the total amount

mortgaged can be twice or even thrice the principal amount loaned depending on

the terms of the lender.

In general,

paying off a home loan the soonest possible time would be more beneficial to

the borrower. For one, he is assured that he owns his home without worrying

about the property being forfeited and in effect losing all his investment.

1. Read and

review the terms of the home loan agreement, Check all the

Financial

and pay off terms to make sure the loan is not totally onerous for the

borrower. Calculate the total amortizations you have to pay and choose a term

that you can easily pay off in a monthly or quarterly period.

2. Always

make the home loan amortization a priority when it comes to budgeting. When the

family income comes in, the borrower should always deduct that amount needed to

pay off the home loan amortization to make sure it is not spent on other

expenses.

3. Ask the

loan provider if a rebate is given for early or on time payments. Some lenders

give a rebate every time the amortization is paid on or before the cut off

date. The savings you will get from paying early can be given to the lender as

an advance home payment. The amount may be meager but it will add up and will

later lessen the paying period.

4. Allot a

percentage or better yet, apply all the bonuses and other financial gains to

the home loan payment. This will be considered as an advanced payment and will

get you a breather in case there is an emergency and the money for the home

loan is used for a more important expense like health emergencies.

5. Always be

vigilant about how the interest rates go up and down. When the interest rates

fall down substantially, refinancing the home loan may just be the best option.

However, make sure that the refinancing scheme will lessen the financial burden

on your part.

6. Encourage

family members to take on extra work or projects to add to the family income.

The benefits of owning a home will redound to the whole family so it is

important to make the members aware that pitching in home loan payment will

always work for the benefit of the whole family. Each member who gets and extra

income can allot a portion of that income to paying off the home loan. No

matter how meager that extra income may be, it will add up and will help in

paying off the home loan the soonest possible time.

7. Save,

save and save. Owning a home is a project that requires the head of the family

and even the family members to save and scrimp to pay off the loan fast. The family

can help by saving on energy consumption or other household expenses. The

savings from other household expenses can be used to add to the home loan

payment.

For average

income earners, only a home loan can make the dream of owning a home a reality.

No matter how meager the monthly income is, there is always a chance of owning

a home. However, the family should find ways to pay off the home loan fast so

they can finally and totally own their home.

Wednesday, 11 January 2017

Calculate Your Monthly Installments With a Car Loan EMI Calculator

Those people

contemplating buying a car with the help of a loan can often benefit from being

able to calculate anticipated costs. By having a rough guide on figures to

refer to, it can make it a lot easier to evaluate all the possible options

available. Online you can find many free examples of the car loan online EMI

calculator.

This useful

little web based number cruncher will be all you need to calculate your own

particular set of figures to work from. These special calculators can help you

work out possible monthly installments on credit variations.

The letters

E, M and I in the car loan online EMI calculator stand for equated monthly

installments. This explains perfectly what this adding machine does. It simply

computes the required monthly payment from the input details you supply. The

car loan online EMI calculator needs only the number of installments, the

annual interest rate and the loan amount in order to compute results. When you

give this handy gadget the information it needs it will reward you with an

estimated total for each four weekly payment. This will allow you to judge its

overall affordability for you. It can also be used to determine the level your

borrowing can be comfortably afforded at.

The car loan

online EMI calculator

is perfect for estimating the costing of fixed term borrowing and can often be

found on most good lenders sites. When looking through various options for

lending you should take a note of loan amounts, interest rates and installment

numbers for each offer. You can then use this useful computing tool to assess

the value and suitability of each. Cost is not everything of course however it

is an important consideration that is an essential element in your evaluations.

Being able

to add up how much you will actually be paying each month beforehand is a

sensible way to judge affordability. The car loan online EMI calculator is a

useful assistant in your quest to find the best value for money and the most

suitable term period. It gives those wishing to borrow a method to investigate

the potential costs in a straight forward and quick manner. If the installment

amounts are too high the car loan online EMI calculator can easily be revisited

again with a new loan configuration to calculate. This can be repeated until

the perfect loan amount, term and number of installments is discovered.

If you have

an idea in your head of the amount you have accounted for your repayments then

using the car loan online EMI calculator will be a good idea. It can help you

fine tune your choice of loan for maximum affordability. It will ensure that

you are opting for the right level of credit within your means and this guides

you towards sensible and realistic choices. Buying a car on credit can seem a

good deal until you analyze the true cost. By knowing the rough repayment

amount you can afford using the car loan online EMI calculator you will not

find yourself unnecessarily over burdened.

Wednesday, 4 January 2017

How do I Calculate Income Tax on Salary?

Use the interactive online emi calculator to calculate your home loan EMI. Get all details on interest payable and tenure using the housing loan calculator.

Tuesday, 3 January 2017

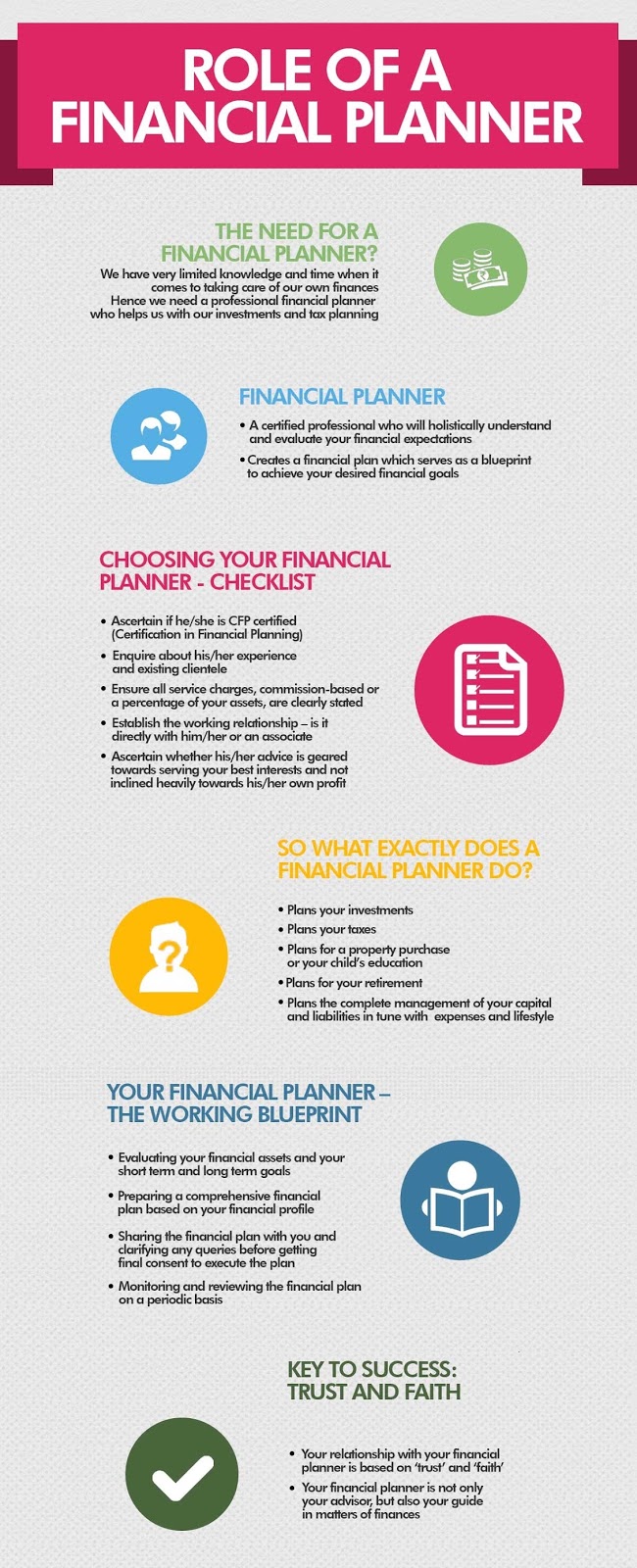

Role of a financial planner

Use the interactive emi calculator online to calculate your home loan EMI. Get all details on interest payable and tenure using the housing loan calculator.

Subscribe to:

Comments (Atom)