As the adage

goes, something that cannot be measured cannot be improved. This fact is

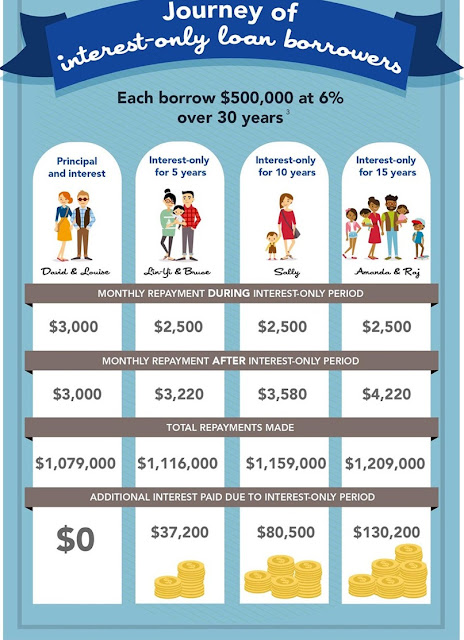

inclusive of most things in life including home loans. If you're looking to

live a debt free life, first make sure you calculate how much you can afford to

spend. A home loan calculator is a great tool that'll help you get an idea of

the monthly and yearly payment breakdowns. The calculator allows you to assess

your mortgage payment options.

While some

provide a simple calculation of the monthly spending that you can afford, after

you key in the interest rate and the other expenses, there are some others that

are elaborate and help you calculate several things. For example, if you'd like

to know the maximum housing loan amount based on the annual income and the

ability to service the loan, choose from an online emi calculator that

determines the affordability of your loan. All that you've got to enter is the

monthly salary, the start interest rate, the loan term period and the maximum

percentage of income that you can afford to spend, and you have a calculator

that tells you the maximum loan amount that you can ask, and the maximum

monthly mortgage payment that you can make.

You can also

find out how susceptible you are to changes in interest rates in the market.

Enter the principal amount, interest rate variation and the loan period, and

you can know how changes in the interest rate can affect your monthly

expenditures. And if you're an investor, you can look at a online emi

calculator that gives you the potential yield from your investment.

Depending on

the amount that you can afford, or the interest rate or the term period that's

best for you, you can choose from a loan provider. And if you've already

availed a loan, the home loan calculator can help you determine the monthly

income that's need to stay afloat and avoid a foreclosure. There are several

variants of the calculator, make sure that you are in tune with the method of

calculation with the loan provider.

Rather than

having to make complex calculations, where you often lose track of what you

were calculating in the first place, or ask for help from your finance

consultant, it's best to use a home loan calculator that can do all the

calculation for you. You end up saving time, and energy using these calculators

that can easily perform the most complex of calculations. But choose from a

good website, rather than visiting the first site that's thrown up on the

search result.